pa auto sales tax

Well get you in the perfect car truck or SUV for your lifestyle. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

Griffith Auto Sales Car Dealer In Home Pa

This is the total of state county and city sales tax rates.

. The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. Nine-digit Federal Employer Identification. If the vehicle will be registered in Allegheny County PAs 2 nd most populous county theres an added 1 local sales tax for a.

Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of. If the vehicle is being given as a gift the Form MV-13ST PDF Affidavit of Gift must be attached to the title application. Pennsylvania charges a flat rate of 6 sales tax on most vehicle purchases in the state.

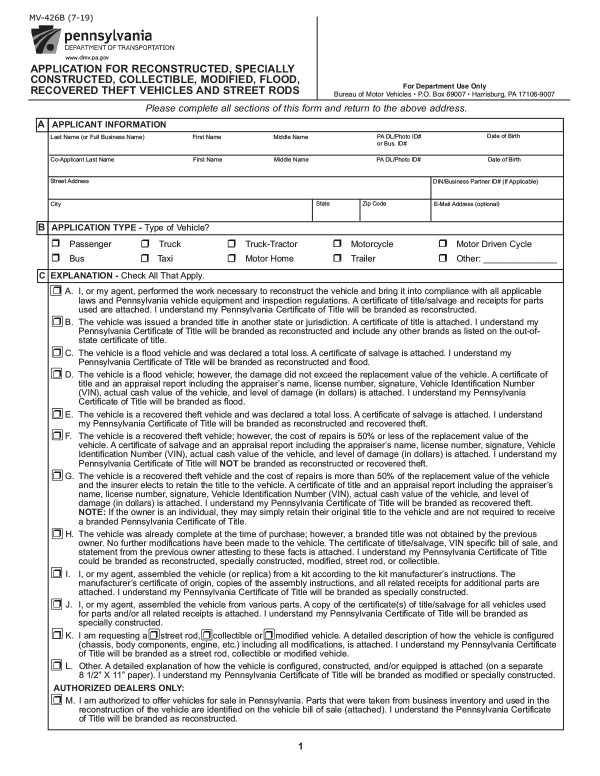

The license plate should be returned to PennDOT at Bureau of Motor Vehicles Return Tag Unit PO. The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. To determine if your county participates in the Fee for Local Use please refer to the Fee for Local Use Participating Counties Fact Sheet located on our website at.

Tax Time Sales Event. In Oklahoma the excise tax is. 45 percent on transfers to.

For example the rate in Allegheny County is. For instance if your new car costs. Some counties impose additional surtaxes however.

This form must be. The information provided on this page is for informational purposes only and does not bind the department to any entity. Pennsylvania has three alcoholic beverage taxes.

The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. Statutory or regulatory changes. The state sales tax rate for leasing a motor vehicle in Pennsylvania is six percent.

You need a pa sales tax license and you need to. Exact tax amount may vary for different items. Vending vacs bays etc.

The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny. At PA Auto Sales we finance everyone. In addition to the state and local.

Inheritance and Estate Tax. The Pennsylvania sales tax rate is 6 percent. Effective October 30 2017 a prorated partial day fee for carsharing services was.

VIN verification is required for out of state vehicles. Its a good time to get a car. The Pennsylvania sales tax rate is currently 6.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is. PA Auto Sales is proud to announce our Tax Time Special Sales Event. Some dealerships may also charge a 113 dollar document preparation charge.

The following is what you will need to use TeleFile for salesuse tax. Eight-digit Sales Tax Account ID Number. 2022 Pennsylvania state sales tax.

By law a 1 percent local tax is added to purchases made in Allegheny County and 2 percent local tax is added to purchases made in Philadelphia. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. Residents in Allegheny County though pay 7 tax and those in the city Philadelphia.

The use tax return is the same as the sales tax return. Sales Use Tax Taxability Lists. Box 68597 Harrisburg PA 17106-8597 unless the seller is planning to transfer the plate.

The minimum combined 2022 sales tax rate for Easton Pennsylvania is 6. PA has a 6 sales tax rate for motor vehicles. Pennsylvania Vehicle Registration Taxes Fees.

Avail Discounts Ranging Up to 1000. You have to pay sales tax on all of your carwash sales in PA. Call Sales Phone Number 215-330-0539 Service.

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara

What Are The Vehicle Registration Taxes Fees In Pennsylvania Tri County Toyota

Sales Tax On Cars And Vehicles In Pennsylvania

Sales Taxes In The United States Wikipedia

Colorado Standard Sales Tax Receipt Pad Bpi Dealer Supplies

B D Auto Sales Inc Car Dealer In Fairless Hills Pa

Car Tax By State Usa Manual Car Sales Tax Calculator

Buying A Car In Pennsylvania If You Live In Ny Protect My Car

Nj Car Sales Tax Everything You Need To Know

Used Deals R Us Auto Sales For Sale With Photos Cargurus

Surprise U Turn Sees Government Extending Sales Tax Sst Exemption Discount To June 2021 Wapcar

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

Free Pennsylvania Bill Of Sale Forms Pdf Word

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Tax Refunds Boost Used Car Sales

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

New Cars Are Hot In Idaho Local News Idahopress Com

Delaware Vehicle Sales Tax Fees Find The Best Car Price

Fellah Auto Group The Home Of No Money Down Used Car Dealerships